Status: Proposed

Timeframe: 2026-2030

AIIB Investment Amount: 200 million USD

Energy type: Gas

Status: Proposed

Timeframe: 2026-2030

Area: China, Inner Mongolia

AIIB Investment Amount: 200 million USD

Total Project Cost: 310.25 million USD

Co-financier: People’s Republic of China

E&S Category: A

Project details: The project includes the construction of five hydrogen-blended gas pipeline sections totaling 463 km, four integrated energy service stations, and a 10 MW solar photovoltaic plant. Three of the five pipeline sections (Sections 3–5) will connect the Datang Keshiketeng coal-to-gas plant to the regional pipeline network. The remaining two sections (Sections 1–2) will transport gas from the Changqing gas field

Project Concerns:

Environmental

Status: Approved

Timeframe: 2026-2027

AIIB Investment Amount: 63 million USD

Energy type: Biomass

Status: Approved

Timeframe: 2026-2027

Area: Thailand

AIIB Investment Amount: 63 million USD

Total Project Cost: 677 million USD

Co-financier: Asian Development Bank

E&S Category: B

Project details: The Project involves the development, construction, and operation of 12 industrial waste to energy (IWTE) power plants in Thailand.

Project Concerns:

Status: Approved

Country: Chile

Timeframe: 2025-?

AIIB Investment Amount: 10 million USD

Status: Approved

Timeframe: 2025-?

Area: Chile, Valparaíso region

AIIB Investment Amount: 10 million USD

Total Project Cost: -

Co-financier: -

E&S Category: FI

Project details: The Aguas Pacifico Project is a desalination initiative in Chile’s central region. According to AIIB, it aims to provide a sustainable freshwater source in response to rising water scarcity and climate-related drought risks. It will be implemented in two phases: Phase I includes the construction of a 1,000 liters per second (l/s) desalination plant, a 104 km aqueduct, and an electricity substation. Phase II will expand the plant’s capacity to 2,000 l/s.

Project Concerns:

Status: Approved

Country: Pakistan

Timeframe: 2021-2028

AIIB Investment Amount: 250 million USD

Energy type: Hydro

Status: Approved

Timeframe: 2021-2028

Area: Pakistan, Khyber Pakhtunkhwa Province, Mansehra District

AIIB Investment Amount: 250 million USD

Total Project Cost: 755 million USD

Co-financier: ADB, Government of Pakistan

E&S Category: A

Project details:

The project aims to enhance energy security and expand renewable energy in Pakistan through the construction of a 300 MW run-of-river hydropower plant on the Kunhar River in Khyber Pakhtunkhwa. The objective is to increase clean energy capacity, support local economic development, and promote climate resilience and gender-inclusive community training programs.

Project Concerns: (comprised finding from CSO factsheet linked below)

Resettlement

Status: Proposed

Country: Sri Lanka

Timeframe: 2026-2027

AIIB Investment Amount: 20 million USD

Energy type: Solar

Status: Proposed

Timeframe: 2026-2027

Area: Sri Lanka, Sampur

AIIB Investment Amount: 20 million USD

Total Project Cost: 144 million USD

Co-financier: ADB

E&S Category: B

Project details:

The project aims to reduce Sri Lanka’s reliance on hydrocarbon imports by supporting the development of a 120 MW solar photovoltaic plant in Sampur. Implemented by TPCL, a joint venture between Ceylon Electricity Board and India’s NTPC, the project will be built in two phases and financed through a mix of sovereign and non-sovereign loans led by AIIB and co-financed by ADB.

Project Concerns: (findings from NGO Forum on ADB's "AIIB Observer" linked below)

Status: Approved

Country: Brazil

Timeframe: 2023

AIIB Investment Amount: 200 million USD

Status: Approved

Timeframe: 2023

Area: Brazil

AIIB Investment Amount: 200 million USD

Total Project Cost: 200 million USD

Co-financier: -

E&S Category: FI

Project details: A USD 200 million on-lending facility to Banco BTG Pactual S.A. to expand renewable energy in Brazil, focusing on solar and wind projects, with goals of increasing installed capacity, reducing greenhouse gas emissions, and financing multiple clean energy initiatives.

Status: Approved

Country: India

Timeframe: 2025-?

AIIB Investment Amount: 150 million USD

Status: Approved

Timeframe: 2025-?

Area: India

AIIB Investment Amount: 150 million USD in INR equivalent

Total Project Cost: 150 million USD

Co-financier: -

E&S Category: FI

Project details: The project aims provide 150 million USD in INR equivalent in debt financing to Aditya Birla Finance Limited (ABFL), a 100% subsidiary of Aditya Birla Capital Limited, to support renewable energy and e-mobility projects in India, fostering a low-carbon transition and reducing greenhouse gas emissions through non-convertible debenture (NCD) financing. ABFL is a non-banking finance company providing lending and financing solutions in India, including project finance loans, corporate loans, SME loans and personal loans.

Status: Approved

Country: Côte d’Ivoire

Timeframe: 2024-2029

AIIB Investment Amount: 200 million USD

Status: Approved

Timeframe: 2024-2029

Area: Côte d’Ivoire

AIIB Investment Amount: 200 million USD

Total Project Cost: 571.2 million USD

Co-financier: World Bank

E&S Category: B

Project details: The project aims to upgrade and climate-proof roads in 11 regions of northern Côte d’Ivoire, enhancing transport connectivity and access to essential services. It includes climate-resilient rural infrastructure, support of agricultural logistics, and strengthening of institutional capacity for road safety and maintenance.

Project Concerns:

Status: Approved

Country: Bangladesh

Timeframe: 2025-2027

AIIB Investment Amount: 100 million USD

Energy type: Biomass

Status: Approved

Timeframe: 2025-2027

Area: North Dhaka, Bangladesh

AIIB Investment Amount: 100 million USD

Total Project Cost: 467 million USD

Co-financier: New Development Bank (NDB)

E&S Category: A

Project details: The project will develop a 42.5 MW waste-to-energy (WtE) facility in North Dhaka, processing municipal solid waste aiming to reduce landfill use and generate energy. Located near the Amin Bazar landfill, it includes four incineration lines, two 35 MW turbo-generator systems, a six-kilometer transmission line, and long-term agreements with government agencies for implementation, power purchase, waste supply, and land use.

Status: Approved

Country: Uzbekistan

Timeframe: 2024-2025

AIIB Investment Amount: 150 million USD

Energy type: Wind

Status: Approved

Timeframe: 2024-2025

Area: Uzbekistan

AIIB Investment Amount: 150 million USD

Total Project Cost: 2,543 million USD

Co-financier: ADB

E&S Category: A

Project details:

The project involves the development of a 1,500 MW wind power plant and a 300 MWh Battery Energy Storage System (BESS) in the Karakalpakstan region of Uzbekistan. Implemented by a Special Purpose Vehicle (SPV) majority-owned by ACWA Power, the project includes a 25-year Power Purchase Agreement with JSC National Electric Grid of Uzbekistan as the offtaker. It aims to enhance renewable energy capacity and support Uzbekistan's transition to clean energy. It includes the installation 800km of overhead transmission lines (OHTL) through Uzbekistan.

Project Concerns:

Status: Approved

Country: Uzbekistan

Timeframe: 2024

AIIB Investment Amount: 30 million USD (in CNY)

Energy type: unknown

Status: Approved

Timeframe: 2024

Area: Uzbekistan

AIIB Investment Amount: 30 million USD (in CNY)

Total Project Cost: 30 million USD

Co-financier: -

E&S Category: FI

Project details: The project aims to support climate change mitigation in Uzbekistan by financing energy efficiency and renewable energy sub-projects, including rooftop solar installations. It involves a USD 30 million five-year, senior unsecured loan to Asakabank, denominated in CNY (approximately CNY 215 million). The loan proceeds will be on-lent to eligible subprojects focused on energy efficiency and renewable energy initiatives.

Status: Approved

Country: Uzbekistan

Timeframe: 2020 - ?

AIIB Investment Amount: 165.5. million USD

Status: Approved

Timeframe: 2020 - ?

Area: Burkhara Region, Uzbekistan

AIIB Investment Amount: 165.5 million USD

Total Project Cost: 214.7 million USD

Co-financier: Government of Uzbekistan

E&S Category: B

Project details: The project aims to enhance road efficiency, safety, and climate resilience of major cross-border roads in Bukhara, Karakalpakstan, and Khorezm regions. It involves rehabilitating and maintaining a critical section of international road A380 (km 150+000 to km 228+000) and includes construction supervision, technical audit consultancy, project preparation, institutional strengthening, and equipment purchase for innovative contracting methodologies. Components focus on rehabilitation, detailed design, capacity building, and equipment procurement to modernize road infrastructure and management practices.

Status: Approved

Country: Uzbekistan

Timeframe: 2023 - ?

AIIB Investment Amount: 145 million USD

Energy type: Solar

Status: Approved

Timeframe: 2023 - ?

Area: Uzbekistan

AIIB Investment Amount: 145 million USD

Total Project Cost: 634 million USD

Co-financier: European Bank for Reconstruction and Development, Asian Development Bank, European Investment Bank, Masdar (Abu Dhabi Future Energy Company PJSC)

Energy type: Solar

E&S Category: B

Status: Approved

Country: Uzbekistan

Timeframe: 2020 - ?

AIIB Investment Amount: 100 million USD

Energy type: Gas

Status: Approved

Timeframe: 2020 - ?

Area: Shirin, Uzbekistan

AIIB Investment Amount: 100 million USD

Total Project Cost: 1.02 billion USD

Co-financier: EBRD, DEG, OPEC Fund for International Development, ACWA Power Sirdarya LLC

Energy type: Gas

E&S Category: A

Project details: The project aims to enhance high-efficiency gas power generation capacity in Uzbekistan by constructing, operating, and maintaining a 1,500MW greenfield combined-cycle gas turbine (CCGT) plant. ACWA Power is developing the project as an Independent Power Producer (IPP), under a 25-year Power Purchase Agreement with JSC National Electric Networks of Uzbekistan (NENU) since March 2020.

Project Concerns:

Status: Approved

Country: Pakistan

Timeframe: 2016-2022

AIIB Investment Amount: 100 million USD

Status: Approved

Timeframe: 2016-2022

Area: Pakistan, Punjab Province, between Shorkot and Khanewal

AIIB Investment Amount: 100 million USD

Total Project Cost: 273 million USD

Co-financier: Asian Development Bank; Foreign, Commonwealth and Development Office United Kingdom; Government of Pakistan

E&S Category: A

Project details: The project constructed a 62 km four-lane, access-controlled motorway connecting Shorkot and Khanewal in Punjab Province, which was the last missing section of the national motorway M-4 to be constructed.

Status: Approved

Country: Uzbekistan

Timeframe: 2020-2025

AIIB Investment Amount: 385.1 million USD

Status: Approved

Timeframe: 2020-2025

Area: Burkhara Region, Uzbekistan

AIIB Investment Amount: 385.1 million USD

Total Project Cost: 437.62 million USD

Co-financier: Government of Uzbekistan

E&S Category: A

Status: Approved

Country: Uzbekistan

Timeframe: 2022 - 2026

AIIB Investment Amount: 108 million USD

Status: Approved

Timeframe: 2022 - 2026

Area: Uzbekistan

AIIB Investment Amount: 108 million USD

Total Project Cost: 445.65 million USD

Co-financier: Asian Development Bank, Government of Uzbekistan and Uzbekistan Railways

E&S Category: A

Project details: The project aims to enhance freight and passenger railway services in Western Uzbekistan by electrifying the Bukhara-Miskin-Urgench-Khiva line. It involves upgrading the existing 465 km railway with electrification, signaling, telecommunication, and traction power management systems.

Status: Approved

Country: Uzbekistan

Timeframe: 2021 - 2027

AIIB Investment Amount: 100 million USD

Status: Approved

Timeframe: 2021 - 2027

Area: Uzbekistan

AIIB Investment Amount: 100 million USD

Total Project Cost: 240 million USD

Co-financier: World Bank, Government of Uzbekistan

E&S Category: B

Project details: The project aims to enhance urban infrastructure in secondary cities. It includes investment in water supply, sanitation, energy efficiency, and urban regeneration. Additionally, it focuses on institutional strengthening, capacity building, and supporting sustainable urbanization policies. Emergency response measures are supposed to ensure flexibility in crisis situations.

Status: Approved

Country: Uzbekistan

Timeframe: 2022 - ?

AIIB Investment Amount: 248.4 million USD

Status: Approved

Timeframe: 2022 - 2027

Area: Burkhara Region, Uzbekistan

AIIB Investment Amount: 248.4 million USD

Total Project Cost: 281.3 million USD

Co-financier: Government of Uzbekistan

E&S Category: A

Project details:

The project aims to enhance water and sanitation services in Uzbekistan's Bukhara Region, bolstering the operational performance of the local water utility. It represents the second phase of a broader initiative by the government to extend these services comprehensively across the region. Key components include investment in water supply infrastructure, covering districts Gijduvon, Vobkent, and Shofirkon, and sewage infrastructure, including centralized systems in district centers and the extension of sewerage networks in Bukhara City.

Project Concerns:

Status: Approved

Country: Cambodia

Timeframe: 2024 - ?

AIIB Investment Amount: USD 80 million

Status: Approved

Timeframe: 2024-?

Area: Cambodia, Pursat and Sangker River Basin

AIIB Investment Amount: USD 80 million

Total Project Cost: USD 176 million

Co-financier: ADB, Government of Cambodia

E&S Category: B

Project Details:

The project aims to improve the irrigation water availibility in the dry season and to manage wet season flooding.

Project concerns:

The project requires land acquisition of agricultural land of private households along the irrigation canals and for the construction of flooding controlling schemes. The project is situated in areas possibly inhabited by ethnic Cham communities. These communities will also be impacted by land acquisition.

The project is expected to affect approximately 231 households or 975 people, including the physical relocation of 169 people. At least 21 businesses will be impacted permanently, affecting 110 people. An estimated 36 households (179 people) will suffer major livelihood impacts due to business loss, resettlement or both.

Status: Approved

Country: Tajikistan

Timeframe: 2023-?

AIIB Investment Amount: 500 million USD

Status: Approved

Timeframe: 2023- ?

Area: Tajikistan

AIIB Investment Amount: 500 million USD

Total Project Cost Completion: estimated at more than USD 6.4 billion (this does not include previous expenditure. The dam was built from 1976-1991 and from 2006-2024. The total cost of completing the project should include expenditures already made: USD 1.4 billion in Soviet times and USD 3.6 billion by Tajikistan)

Co-financier:

WB: 700 million USD

EIB: 550 million USD

ADB: 500 million USD

IsDB: 150 million USD

OPEC Fund: 100 million USD

Kuwait Fund for Arab Economic Development: 100 million USD

Abu Dhabi Fund for Arab Economic Development: 100 million USD

Saudi Fund for Development: 100 million USD

Bilateral Agencies (unidentified): 450 million USD

Borrowing Agency: 1250 million USD

Borrower: 2140 million USD

Status: Proposed

Country: Türkiye

Timeframe: 2020-

AIIB Investment Amount: EUR 125 million

Status: Proposed

Timeframe: 2020- ?

Area: Izmir, Türkiye

AIIB Investment Amount: EUR 125 million

Total Project Cost: EUR 650 million

Co-financier: EBRD, AFD and other lenders

E&S Category: B

Project details:

The project involves building a new 13.4 km metro line (M2) in Izmir, connecting central areas to a heavily populated district. It aims to ease traffic by offering efficient public transport, includes 11 stations and interchanges with existing lines, and will take about 4 years to complete.

Status: Approved

Country: Türkiye

Timeframe: 2023- ?

AIIB Investment Amount: USD 250 million

Status: Approved

Timeframe: 2023- ?

Area: Türkiye

AIIB Investment Amount: USD 250 million

Total Project Cost: USD 1,100 million

Co-financier: World Bank

E&S Category: B

Project details:

The project aims to boost efficiency and resilience in Turkey's railway system. It includes installing modern systems along a 660-kilometer corridor, improving infrastructure like bridges and stations, and deploying digital tech for enhanced safety and network strength.

Project Concerns:

There is documented presence of several Key Biodiversity Areas (KBA), national parks, lakes, rivers/streams, and critical habitats in the vicinity of the railway alignment.

It is emphasized that the project is expected to require land, primarily state-owned land along the railway route. Resettlements are anticipated, mainly from state forest areas, pastureland, and private land.

Status: Approved

Country: Türkiye

TimeFrame: 2020-?

AIIB Investment Amount: EUR 125 million

Status: Approved

Timeframe: 2020-?

Area: Istanbul, Türkiye

AIIB Investment Amount: EUR 125 million

Total Project Cost: EUR 1.2 billion

Co-financier: European Bank for Reconstruction and Development (EBRD) and other Lenders: Rönesans Holding A.Ş. (Rönesans or the Sponsor), Meridiam SAS (Meridiam)

E&S Category: A

Project details:

The Project aims to complete the eighth section of the long-term project (20 years) North Marmara Highway (NMH and is part of the long-term (20 years) General Directorate of Highways (KGM)’s Development Program), planning to connect Asia and Europe. Constructing a 30.64-kilometer toll road, including a cable-stayed bridge, linking Nakkaş and Başakşehir in Istanbul. Once completed, it's expected to boost economic activity in Istanbul, improve regional connectivity, ease city traffic jams, promote electric vehicles, and prioritize climate-resilient design against extreme weather.

Status: Proposed

Country: Nepal

Timeframe: 2018-?

Estimated Date of Board Consideration: 2019 Q4

AIIB Investment Amount: US$ 112 million

Energy: Hydro

Status: Proposed

Timeframe: 2018-?

Estimated Date of Board Consideration: 2019 Q4

Area: Tamakoshi river/basin in Janakpur, Nepal

AIIB Investment Amount: US$ 112 million

Total Project Cost: US$ 165 million

Co-financier: GoN/NEA

E&S Category: A

Project Details: The project is a 101 MW run-of-river hydro generation plant. It aims to bridge the supply and demand gap by injecting extra power into the national grid, while also contributing to grid stability and meeting the daily peak demand.

Project concerns: According to early estimates in the Project Summary, 35 households (consisting of approximately 177 individuals) are expected to be affected by land acquisition impacts, primarily in terms of economic displacement, with two of these households expected to experience physical displacement.

There is still no approved ESIA (as of 2026) available for the project, however the project developer is inviting bids for electromechanical equipment and transmission line works.

Status: Approved

Country: Indonesia

Timeframe: 2018-2024

AIIB Investment Amount: US$ 248.4 million

Status: Approved

Timeframe: 2018-2024

Area: Indonesia, Mandalika region of Lombok

AIIB Investment Amount: US$ 248.4 million

Total Project Cost: US$ 316.5 million

Co-financier: Government of Indonesia (GoI); Indonesia Tourism Development Corporation (ITDC)

E&S Category: A

Project Details: The project aims to develop sustainable core infrastructure for a new tourism destination in Mandalika, Lombok as part of the “10 New Balis” strategy. Focused on Phase I (2019–2023), it includes the construction of essential infrastructure within Mandalika and improvements in nearby communities

Project concerns:

Status: Approved

Country: Cambodia

Timeframe: 2022-2023

AIIB Investment Amount: US$ 100 million

Status: Approved

Timeframe: 2022-2023

Area: Cambodia

AIIB Investment Amount: US$ 100 million

Total Project Cost: Up to US$ 100 million

E&S Category: FI

Project Details: The project is a non-sovereign backed loan to ACLEDA Bank (ACLEDA), to expand its lending to eligible private sector micro, small and medium-sized enterprises (MSMEs) in Cambodia.

Resettlement: The frequent use of land titles as collateral for microloans in Cambodia, combined with reports of predatory lending and abusive collection practices, has been widely criticized for dispossessing borrowers of their land without the use of legal foreclosure methods and contributing to poverty and involuntary resettlement. Reported abuses include the microloan activities of ACLEDA Bank Plc., which this AIIB project will be funding.

Organizations monitoring: Equitable Cambodia; Cambodian League for the Promotion and Defense of Human Rights (LICADHO)

Status: Approved

Country: Cambodia

Timeframe: 2022-2023

AIIB Investment Amount: US$ 75 million

Status: Approved

Timeframe: 2022-?

Area: Cambodia

AIIB Investment Amount: US$ 75 million

Total Project Cost: Up to US$ 75 million

E&S Category: FI

Project Details: The project is a non-sovereign backed loan to PRASAC Microfinance Institution Plc. (PRASAC), to support and expand its lending to eligible private-sector micro, small and medium sized enterprises (MSMEs) in Cambodia.

Resettlement: The frequent use of land titles as collateral fomedium-sized in Cambodia, combined with reports of predatory lending and abusive collection practices, has been widely criticized for dispossessing borrowers of their land without the use of legal foreclosure methods and contributing to poverty and involuntary resettlement. Reported abuses include the microloan activities of PRASAC Microfinance Institution Plc., which this AIIB project will be funding.

Status: Approved

Country: Bangladesh

Timeframe: 2017-2021

AIIB Investment Amount: US$ 60 million

Status: Approved

Timeframe: 2017-2021

Area: Bangladesh, between Chittagong and Bakhrabad

AIIB Investment Amount: US$ 60 million

Total Project Cost: US$ 453 million

Co-financier: ADB: US$ 167 million; Government of Bangladesh: US$ 226 million

E&S Category: A

Project Details: The project sets out to improve efficiency in gas production at the Titas Gas Field and to build a 181 km pipeline between Chattogram and Bakhrabad.

Resettlement: According to the updated Resettlement Plan by the ADB from October 2021, in total 802 title-holding households will be displaced by the project. Another 101 non-titled households also face resettlement. While not suffering the loss of residential structures, nearly 8000 further households are in some way affected by land acquisition.

Status: Approved

Country: Bangladesh

Timeframe: 2016-2019

AIIB Investment Amount: US$ 165 million committed; US$ 144.22 million disbursed; US$ 20.88 million cancelled.

Status: Approved

Timeframe: 2016-2019

Area: Rural areas and North Dhaka, People's Republic of Bangladesh

AIIB Investment Amount: US$ 165 million committed; US$ 144.22 million disbursed; US$ 20.88 million cancelled.

Total Project Cost: US$ 262.29 million

Co-financier: Stand-alone project. Financing gaps will be covered by the Government or the respective Executing Agencies (EAs).

E&S Category: B

Project Details: The project has the issue to enhance distribution capacity and increase the number of rural and urban electricity consumers in Bangladesh.

Resettlement: Due to the construction work more than 5,000 hawkers were displaced from an area, but they never received compensation since the area was not listed in the E&S review.

CSO reports and organizations monitoring: Recourse (BIC) (2019): Dangerous Distractions Report

Status: Approved

Country: Bangladesh

Timeframe: 2022-?

AIIB Investment Amount: US$ 110 million

Status: Approved

Timeframe: 2022-?

Area: Bangladesh, Narayanganj District, Dudhghata, Korbanpur and Chanderchak villages

AIIB Investment Amount: US$ 110 million

Total Project Cost: US$ 613 million

Co-financier: Deutsche Investitions- und Entwicklungsgesellschaft (DEG), OPEC Fund, and Standard Chartered Bank (with Swiss Export Risk Insurance (SERV) providing policy cover to Standard Chartered Bank)

E&S Category: A

Project Details: The Project involves the design, financing, engineering, construction, operation, and maintenance of a 584-megawatt (MW) greenfield gas-fired combined-cycle gas turbine (CCGT) plant on a Build-Own-Operate (BOO) basis, to be implemented as an Independent Power Producer (IPP) facility.

Capacity: 584-megawatt (MW)

Construction Company: Unique Meghnaghat Power Limited (UMPL)

Status: Approved

Country: Bangladesh

Timeframe: 2017-2019

AIIB Investment Amount: US$ 60 million

Status: Approved

Country: Bangladesh

Timeframe: 2019-2022

AIIB Investment Amount: US$ 120 million

Status: Approved

Country: Myanmar

Timeframe: 2016-?

AIIB Investment Amount: US$ 20 million

Status: Approved

Timeframe: 2016-?

Area: Taungtha, Myingyan District in Mandalay Division, Myanmar

AIIB Investment Amount: US$ 20 million

Total Project Cost: US$ 304 million

Co-financier: Asian Development Bank: US$ 143 million (+ US$ 110 guarantee); World Bank (International Finance Corporation): US$ 75 million; Others, e.g. UK ́s Private Infrastructure Development Group

E&S Category: A

Project Details: The project involves the development, construction, and operation of a greenfield 225 MW Combined Cycle Gas Turbine (CCGT) power plant in the Mandalay region of Myanmar by Sembcorp Utilities Pte Ltd and MMID Utilities Pte Ltd.

Project concerns:

Status: Approved

Country: Laos

Timeframe: 2019-2023

AIIB Investment Amount: US$ 40 million

Status: Approved

Timeframe: 2019-2023

Area: Sikeut to Songpeuay market to Phonhong, close to Vientiane, Lao People’s Democratic Republic

AIIB Investment Amount: US$ 40 million

Total Project Cost: US$ 128.2 million

Co-financier: World Bank (IDA): US$ 40.2 million; Nordic Development Fund: US$ 9.5 million; Lao government: US$ 38.5 million.

E&S Category: A

Project Details: The project comprises two components: the widening of a road just North of the capital Vientiane and the renovation of the same road a bit further north along the stretch between Songpeuay Market and Phonhong.

Project concerns: In total, 2441 households are affected by land acquisition for the widening of the road. Furthermore, 8 residential structures face demolition meaning that households will have to resettle. Out of all affected households, 378 households belong to families headed by single women without families. They ask for land compensation and reconstruction of their homes and businesses. They request for livelihood restoration prior to the demolition of their houses and vendor places.

Status: Approved

Country: Asia region

Timeframe: 2017-2027

AIIB Investment Amount: US$ 150 million

Status: Approved

Timeframe: 2017-2027

Area: Asia Region (China, India, Indonesia, Philippines, Bangladesh, Cambodia, Myanmar, Sri Lanka, Vietnam, Singapore, Thailand)

AIIB Investment Amount: US$ 150 million

Total Project Cost: US$ 640 million

Co-financier: IFC: US$ 150 million; Other Investors: US$ 340 million

E&S Category: FI

Project Details: The Fund is an Emerging Asia growth-focused private equity fund with a returns-driven strategy, selectively investing growth capital across multiple sectors.

CSO reports and organizations monitoring: Recourse, SOMO, Inclusive Development International (IDI) (2018) – Shwe Taung Cement Case Study;

Recourse, SOMO, Inclusive Development International (IDI) (2018) – Moving Beyond Rhetoric: How the AIIB can close the loophole on fossil fuels;

Status: Approved

Country: Multicountry

Timeframe: 2020-2021

AIIB Investment Amount: US$ 100 million

Status: Approved

Timeframe: 2020-2021

Area: Multicountry - East Asia and Pacific

AIIB Investment Amount: US$ 100 million

Total Project Cost: US$ 666.9 million committed capital

E&S Category: FI

Project Details: The objective is to mobilize private capital investments into infrastructure in AIIB’s members via a fund with a market risk-adjusted return.

Project concerns: Due to the projects categorization as FI the decision-making lays with the borrower, raising concerns about transparency. The specific subprojects to be financed are unclear, as only AIIB's ESP requirements must be met. The project description merely states that involuntary resettlement and impact on indigenous people is to be avoided where feasible.

AIIB interactions to date: Several online meetings with bank management in the aftermath of AIIB AGM 2020.

Further information: AIIB Page

Last update: 09.04.2025

Status: Approved

Country: Maldives

Timeframe: 2020-2027

AIIB Investment Amount: US$ 40 million

Status: Approved

Timeframe: 2020-2027

Area: Greater Malé capital region, Maldives

AIIB Investment Amount: US$ 40 million

Total Project Cost: US$ 151.13 million

Co-financier: ADB; Japan Fund for the Joint Crediting Mechanism (JFJCM); Government of Maldives

E&S Category: A

Project Details: Co-financed with the Asian Development Bank (ADB) this projects sets out to construct a regional waste management facility, including construction of a 500-ton per day (tpd) 8 MW Waste-to-Energy (WTE) plant.

Project concerns: WTE incineration emits hazardous pollutants at all stages, including persistent organic pollutants (POPs) such as dioxins and furans, known to cause cancer, neurological damage, and endocrine disruption.

Additional emissions include heavy metals, sulfur and nitrogen oxides, PFAS, volatile organic compounds, particulate matter, microplastics, and greenhouse gases.

Organizations monitoring: NGO Forum on ADB

AIIB interactions to date: Field visit in May 2022.

Status: Approved

Country: Sri Lanka

Timeframe: 2018-2025

AIIB Investment Amount: US$ 200 million

Status: Approved

Timeframe: 2018-2025

Area: Colombo, Democratic Socialist Republic of Sri Lanka

AIIB Investment Amount: US$ 200 million

Total Project Cost: US$ 287 million

Co-financier: GoSL: US$ 84 million; Private Partner: US$ 5 million

E&S Category: A

Project Details: This project aims to resettle about 50.000 low-income and lower-middle-income households into new high-rise apartment buildings with improved utilities and facilities. AIIB has recently approved financing for the third phase of the project, under which approximately 23,000 people will be resettled in Sri Lanka's capital city.

Project concerns: The current occupants do not hold the legal right to the land, AIIB therefore classifies it as “no involuntary land acquisition”. The project will offer alternate housing for the households who will be displaced by the recovery of their land.

CSO Reports and organizations monitoring: Bank Information Center

Status: Approved

Country: India

Timeframe: 2017-2021

AIIB Investment Amount: US$ 100 million

Status: Approved

Timeframe: 2017-2021

Area: Tamil Nadu, Republic of India

AIIB Investment Amount: US$ 100 million

Total Project Cost: US$ 303.5 million

Co-financier: ADB: US$ 50 million; POWERGRID: US$ 153.47 million

E&S Category: B

Project Details: This Project aims to strengthen the power transmission and generation of energy to provide electricity to Tamil Nadu region.

Project concerns: Under the ADB SPS, the Project is classified Category B for Environmental and Involuntary Resettlement, therefore resettlement is likely to occur.

CSO reports and organizations monitoring: CFA

AIIB interactions to date: None

Further information: AIIB Page; Gender Action Scorecard

Last update: 31.12.2023

Status: Approved

Country: India

Timeframe: 2017-2021

AIIB Investment Amount: US$ 335 million

Status: Approved

Timeframe: 2017-2021

Area: India, Bangalore, Gottigere to Nagavara

AIIB Investment Amount: US$ 335 million

Total Project Cost: US$ 1.785 billion

Co-financier: EIB, Government of India, Government of Karnataka

E&S Category: A

Project Details: Line R6 is to run 22 kms (7.5 km elevated and 14.5 km underground), north to south across Bangalore’s heart and important commercial centers.

As of the end of October 2023 the Grievance Redress Mechanism (GRM) has received 712 complaints, 672 of those have been resolved and further 40 complaints are being attended to. Generally, most of the grievances received are resolved at the level of General Manager (land acquisition) and Director (Projects and Planning).

Project Concerns:

Status: Approved

Country: India

Timeframe: 2022-2027

AIIB Investment Amount: US$ 250 million

Status: Approved

Timeframe: 2022-2027

Area: India

AIIB Investment Amount: US$ 250 million

Total Project Cost: US$ 713.41 million

Co-financier: World Bank

E&S Category: A

Project Details: The project aims to improve the safety and operational performance of selected dams across the country, along with institutional strengthening. Planned is the comprehensive rehabilitation of 736 existing dams.

Project concerns: According to local CSOs multiple of the target dam projects are linked to resettlement and land acquisition legacy issues lasting until today, like for example the controversial Bhakra Dam. The World Bank’s appraisal Environmental and Social Review denies the existence of any legacy issues from the time of construction of any of the dams attached to the project.

CSO reports: NGO Forum on ADB (2022). Bankwatch: "Second Dam Rehabilitation and Improvement Project environmental and social due diligence is a sham if not acted upon"

Status: Approved

Country: India

Timeframe: 2017-2029

AIIB Investment Amount: Up to US$ 37.51 million

Status: Approved

Timeframe: 2017-2029

Area: Mumbai, Republic of India

AIIB Investment Amount: Up to US$ 37.51 million

Total Project Cost: US$ 187.55 million committed capital upon closing on July 6, 2020

E&S Category: FI

Project Details: The fund's strategy is to invest in infrastructure platforms/ services companies with high growth potential that derive their revenues principally from India. Sectors include energy and utilities, transport and logistics, and other sectors, including telecommunications, broadband, urban PPP projects, healthcare and education.

Status: Approved

Country: India

Timeframe: 2017-2019

AIIB Investment Amount: US$ 329 million

Status: Approved

Timeframe: 2017-2019

Area: State of Gujarat, Republic of India

AIIB Investment Amount: 329 million USD

Total Project Cost: 658 million USD

Co-financier: Government of Gujarat

E&S Category: B

Project Details: The project aims to improve all-weather rural road connectivity for 1,060 villages across all 33 districts of Gujarat, potentially benefiting around 8 million people. It involves the construction and upgrading of non-plan roads and planned rural roads, including missing links, culverts, and bridges.

Status: Approved

Country: India

Timeframe: 2017-2020

AIIB Investment Amount: US$ 100 million

Status: Approved

Timeframe: 2017-2020

Area: Republic of India

AIIB Investment Amount: US$ 100 million

Total Project Cost: US$ 600 million

Co-financier: Government of India, ADB

E&S Category: FI

Project Details: NIIF has been set up by the Government of India to address the infrastructure financing gap in the country, particularly on the equity front.

CSO reports: BIC (2018): Case Study

Organizations monitoring: Centre for Financial Accountability

AIIB interactions to date: In mid-March 2018, 31 Indian CSOs wrote to M.M. Kutty, the Executive Director representing India at the AIIB

Further information: AIIB Page

Last update: 31.12.2023

Status: Approved

Country: Uzbekistan

Timeframe: 2022 - 2026

AIIB Investment Amount: € 225 million

Energy type: Gas

Status: Approved

Timeframe: 2022 - 2027

Area: Surkhandarya region, Uzbekistan

AIIB Investment Amount: € 225 million

Total Project Cost: € 1,205 million

Co-financier: Sponsors’ equity and external debts

Energy type: Gas

E&S Category: A

Project Details: The AIIB is proposing to provide a loan of 225 million EUR to support the design, construction, and operation of a new 1560MW Combined Cycle Gas Turbine Power Plant. This is the largest gas plant AIIB has funded to this day.

Capacity: 1,560MW

Construction Company: The project is being developed by Stone City Energy (SCE, 20%), EDF (20%), Siemens Energy (25%) and Nebras Power (35%), through a dedicated project company SCE-Quvvat.

Resettlement: No resettlement is expected as social surveys found all land areas provided for the project to be unoccupied, and no agricultural or other economic activity was observed within the project area.

Organizations monitoring: NGO Forum on ADB

AIIB interactions to date: None so far.

Status: Approved

Country: Pakistan

Timeframe: 2016-2022

AIIB Investment Amount: US$ 300 million

Status: Approved

Timeframe: 2016-2022

Area: Khyber Pakhtunkhwa Province, Pakistan

AIIB Investment Amount: US$ 300 million

Total Project Cost: US$ 823.5 million

Co-financier: World Bank: US$ 390 million; Government of Pakistan: US$ 133.5 million

E&S Category: A

Project Details: The project will boost production at an existing hydro-dam and linking it with new transmission lines to the national grid, adding 1,410 MW capacity.

Total Capacity: 6,298 MW

Resettlement: There are remaining legacy resettlement and land acquisition cases to be settled under the project. Additional resettlement or land acquisition for the construction of the transmission line is to be expected.

CSO reports: BIC (2017): Case Study

Organizations monitoring: Recourse

Status: Approved

Country: Tajikistan

Timeframe: 2017-2021

AIIB Investment Amount: US$ 60 million

Status: Approved

Timeframe: 2017-2021

Area: Nurek, Tajikistan

AIIB Investment Amount: 60 million USD

Total Project Cost: 350 million USD

Co-financier: World Bank; Eurasian Development Bank

E&S Category: A

Project Details: The project aims to rehabilitate three power-generating units of the Nurek Hydropower Plant (HPP), improve operational efficiency, and enhance dam safety. Phase I includes equipment refurbishment, auto-transformer replacement, dam safety upgrades, and technical assistance to strengthen the capacity of utility company Barqi Tojik.

Capacity: 3000MW

Project Concerns: Large hydropower projects like Nurek pose significant environmental and human rights risks, including disruption of river ecosystems, downstream impacts, and the marginalization of affected communities. In the past, the government reintroduced energy rationing for households due to low water levels at Nurek. The country's heavy reliance on the hydropower plant makes its energy supply highly climate-sensitive and unreliable during dry periods.

Status: Proposed

Country: Georgia

Timeframe: 2017-2022

Estimated Date of Board Consideration: 2023

AIIB Investment Amount: US$ 100 million

Status: Proposed

Timeframe: 2017-2022

Estimated Date of Board Consideration: 2023

Area: Georgia, Svaneti Region

AIIB Investment Amount: US$ 100 million

Total Project Cost: US$ 1.083 billion

Co-financier: ADB, EBRD, EIB and KDB

E&S Category: A

Project Details: The project's objective is to increase the country's power generation capacity year-round, reduce dependency on fossil fuel-fired power plants and thus decrease their associated pollution, and reduce electricity imports from neighboring countries.

Capacity: 280 MW

Status: Approved

Country: China

Timeframe: 2017-2021

AIIB Investment Amount: US$ 250 million

Status: Approved

Timeframe: 2017-2021

Area: China, Beijing

AIIB Investment Amount: US$ 250 million

Total Project Cost: US$ 761.10 million

Co-financier: Beijing Municipality: US$ 228.33 million; China CDM Fund: US$ 30 million; Beijing Gas: US$ 252.77 million

E&S Category: B

Project Details: The project is designed to improve air quality and reduce air pollution by replacing dirty coal with natural gas in the rural areas of Beijing (Coal-to-gas).

Project Concerns: The project is the AIIB’s first standalone project in China and raises serious concerns regarding transparency, accountability, and adherence to the Bank’s Environmental and Social Framework (ESF). Despite the ESF’s requirements, critical project information—such as Environmental and Social Assessments, consultation records, and detailed data on the 510 affected villages—has not been disclosed. The publicly available Environmental and Social Management Plan (ESMP) contains only vague references to awareness-raising activities and lacks evidence of meaningful public consultations with affected communities. This raises doubts about whether those impacted were adequately informed or involved in the project planning process.

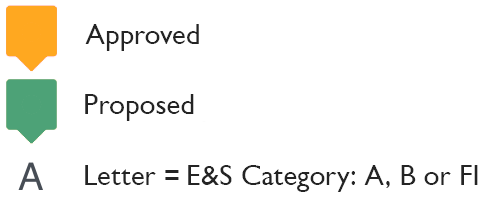

- Legend & Abbreviations

Category A ("highly invasive"): A project that is likely to have significant adverse environmental and social impacts that are irreversible, cumulative, diverse, or unprecedented. These impacts may affect an area larger than the sites or facilities subject to physical works and may be temporary or permanent in nature.

Category B ("less invasive"): A project is categorized B when: it has a limited number of potentially adverse environmental and social impacts; the impacts are not unprecedented; few if any of them are irreversible or cumulative; they are limited to the Project area; and can be successfully managed using good practice in an operational setting.

Category FI: A Project is categorized FI if the financing structure involves the provision of funds to or through a financial intermediary (FI) for the Project, whereby the Bank delegates to the FI the decision-making on the use of the Bank funds, including the selection, appraisal, approval, and monitoring of Bank-financed subprojects.

How to use the Watch?

We used information from the AIIB homepage for the project overview. Please click on the flag on the map to get a summary for each case that provides details and further links to the safeguards harmed. Click on "More information" in the summary to be taken to an extra page on the case.

The whole project is based on collaborative work. The summaries are based on case studies compiled by civil society organizations from Asia, Europe and North America which are named at the end of the summary.

Projects are constantly reviewed, and results are documented on an ongoing basis. The research of the partner organizations often takes place under high risks. The security situation is so volatile that we cannot present all cases or the details of individual cases without endangering the communities.

Why is the AIIB Watch important?

The AIIB's business model is to invest in large infrastructure measures. These measures are associated with serious environmental and social risks. They include natural gas power plants and facilities that will determine greenhouse gas emissions for decades, large dams, and mining projects. A bank specializing in such high-risk mega-infrastructure projects needs strong social and environmental safeguards. Local communities and local as well as international civil society organizations must be heard when it comes to designing and implementing safeguards. Our interactive map lists cases where there is evidence that the AIIB fails to meet its own safeguard standards. The case studies collected here are designed to channel realities on the ground to the broader public. They help to give voice to local communities and testify that standards on paper can never be enough, they must be implemented, and their implementation needs to be independently monitored. Some European countries like Germany made it mandatory for their shareholding to strive for the highest standards in this bank , at least matching with World Bank standards. Fulfilling World Bank standards can also mean watering down the former. "Lean, clean and green" is the tagline given by the AIIB to its Environmental and Social Framework (ESF). By involving former employees of the World Bank in the development of the ESF, the AIIB wanted to prove that its rules stand up to comparison with international standards. In the words of AIIB President Jin Liqun at the 2020 Annual Meeting: "We strive to build a world that is financially, socially, environmentally and economically sustainable."

The Standards

The cases are always analyzed against the valid ESF of the time. The first environmental and social standards approved in 2016 were revised in February 2019 and again in 2021. They were to be reassessed and regularly adjusted after three years based on practical experience with them. The latest review consultations with civil society took place from fall of 2019 to May 2021. The AIIB Watch and the cases documented here informed the revision of the standards. In May 2021, the revised standards were approved and entered into force in October 2021. Urgewald, together with an alliance of Asian and European NGOs, had been involved in the discussion with the AIIB management on possible best practices. Here you can see our comments after the May amendment. The amended ESF applies to all projects approved after October 2021. In November 2022 the ESF was again amended, in June 2024 the amended ESF was updated.

Safeguards explained - Glossary

Glossary of safeguards policies: Each development and investment bank uses their own terms for social and environmental standards. This glossary explains the basic ingredients of all standards used in connection with the operations of the AIIB and other International Financial Institutions (IFIs). The explanation is made through the lens of civil society. We try to show the differences and commonalities when CSOs and AIIB use these terms. Quite frequently, the interpretation differs, and usually, the CSO viewpoint uses a more rights-based approach than the Bank. Access our glossary Further resources AIIB-Watch is shared as a tool on the Coalition for Human Rights in Development resource page. To see further tools and guides visit the overview of resources here .

Further resources

AIIB-Watch is shared as a tool on the Coalition for Human Rights in Development resource page. To see further tools and guides visit the overview of resources here.