Tomorrow the Norwegian Parliament is expected to vote in favor of the government’s proposal to tighten the coal exclusion criteria of Norway’s Government Pension Fund Global (GPFG), Europe’s largest sovereign wealth fund. According to research by the NGOs Urgewald and Framtiden i våre hender (FIVH), this affects 8 coal companies that will be divested. The NGOs estimate the volume of the new divestment action to total €5.1 billion, which is more than the €4 billion the Fund shed in 2015, when it adopted its first coal exclusion criteria.

While the 2015 criteria were based on a company’s relative exposure to coal [1], the new criteria are based on absolute thresholds that capture the world’s largest coal producers and coal plant operators. After the expected parliamentary decision, all companies which are operating over 10 GW of coal-fired capacity or producing over 20 million tons of coal annually will be blacklisted by the Norwegian Government Pension Fund.

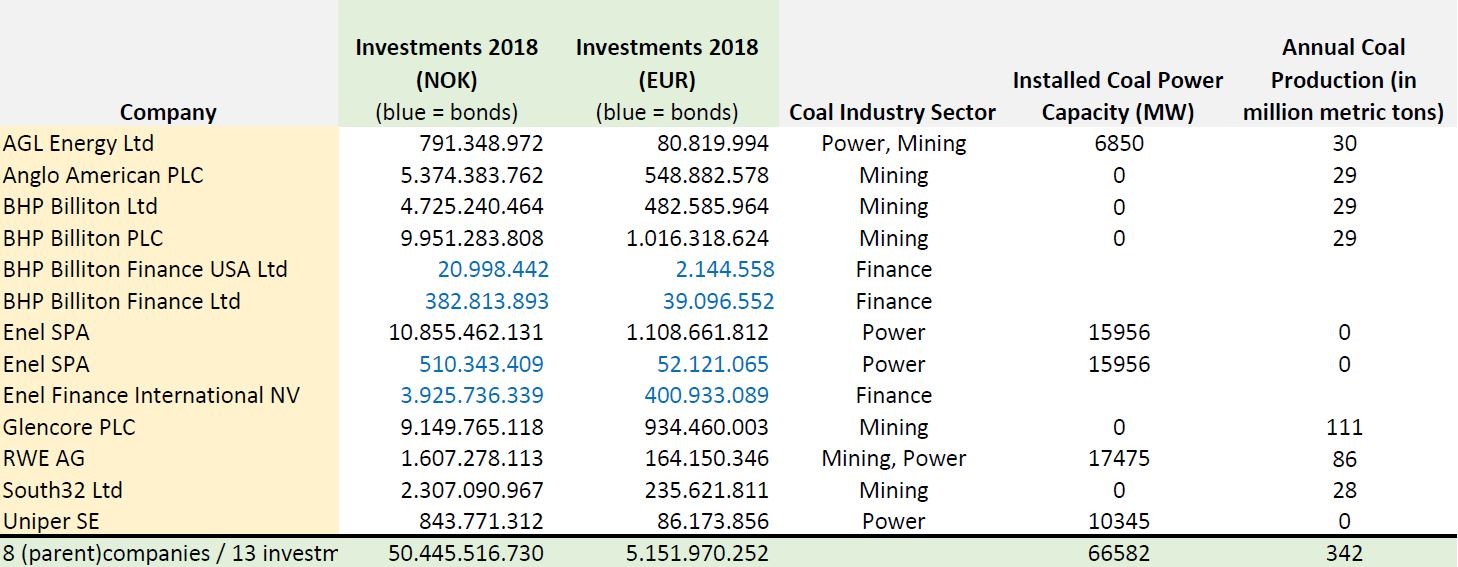

According to Urgewald’s Global Coal Exit List, the following coal companies in the Pension Fund’s portfolio [2] fall under the new criteria: AGL Energy (Australia), Anglo American PLC (UK), BHP Billiton (Australia), Enel (Italy), Glencore (Switzerland), RWE (Germany), South32 (Australia) and Uniper (Germany). The details on these investments are attached.

Heffa Schuecking, director of Urgewald, comments: “It is great to see Norway divesting some of the biggest enemies of the Paris Climate Agreement. And we are happy that the Pension Fund has now adopted 2 of the 3 coal exclusion criteria we put forward in 2015.” [3] According to the NGOs, an important criteria is, however, still missing: the exclusion of companies that are planning new coal plants, coal mines or other coal infrastructure. “Limiting global warming to 1.5°C requires a speedy exit from all coal investments, yet the GPFG is still invested in 18 companies planning new coal power plants. We would like to see the Pension Fund follow the example of Norway’s biggest private investment manager Storebrand and set a date for banning all coal investments,” says Schuecking.

Anja Bakken Riise, Director of the Norwegian NGO Framtiden i våre hender, adds: “This is a timely update of the criteria and adjusts the policy to be in line with the intention from 2015 to be free from thermal coal. We believe however that the government should also say no to investing in companies planning increased coal power or mining production as we know that it is not compatible with our climate goals. It is a missed opportunity to adjust the coal criterion without including these.”

__________

[1] The Fund dismissed coal companies that derive 30% of their revenues from coal or generate 30% of their power by burning coal.

[2] According to the GPFG’s Holdings List published in February 2019.

[3] Details on Urgewald’s Coal Exclusion Criteria: https://coalexit.org/methodology

ANNEX