Report, 2025

190 oil and gas companies from 42 countries are exploring and developing new hydrocarbon reserves or building new fossil fuel infrastructure in Latin America and the Caribbean. Many of the region’s indigenous territories and most vulnerable ecosystems are threatened by oil and gas exploitation. “Big players like Petrobras, ExxonMobil, YPF and Chevron are bent on extracting as much oil and gas as possible before net-zero deadlines take hold,” says Heffa Schücking, director of Urgewald and lead author of the report.

More than 8,800 km of new oil and gas pipelines and 19 new LNG export terminals are proposed or under development in the region. The majority of LNG export terminals are planned in Mexico and Argentina, and threaten unique marine biodiversity hot spots like the Bay of California and the San Matías Gulf. 54,000 MW of new gas-fired power plants are also on the drawing board in Latin America. Almost two-thirds of these gas power plants are planned in Brazil.

92% of bank financing for fossil fuel expansion in Latin America and the Caribbean comes from outside the region, primarily from Europe, the US and Canada. Over the past 3 years, the top financiers were the Spanish bank Santander ($9.9bn), followed by JPMorgan Chase ($8.1bn), Citigroup ($7.9bn) and Scotiabank ($7.2bn).

On the investor side, over 6,400 institutional investors hold US $425 billion in shares and bonds of companies developing new fossil fuel projects in Latin America and the Caribbean. The top 3 institutional investors are Vanguard ($40.9bn), BlackRock ($35.3bn) and Capital Group ($16.8bn) from the US.

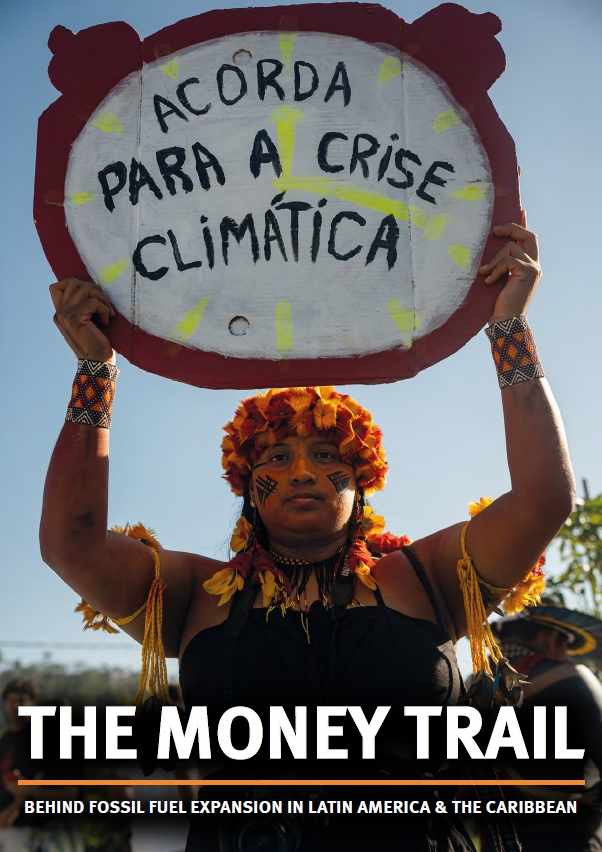

The report tells the stories of communities that are fighting coal, oil and gas projects and features in-depth case studies from Argentina, Brazil, Colombia, Ecuador, Guyana, Mexico, Peru and Suriname. It is supplemented by an online fossil fuel expansion monitor and finance dashboard that can be accessed at https://whofundsfossilfuels.com/.