UK banks claim to stand for responsibility, stability, and foresighted business practices. But what if that reputation is endangered by investments in environmental destruction and the climate crisis?

HSBC and Standard Chartered are leading financiers of the Philippine conglomerate San Miguel. The group, through its energy arm San Miguel Global Power, already operates 8 out of 35 gas-fired power plants in the Philippines. It plans 8 more, alone or with corporate partners. This makes San Miguel the largest gas expansionist in the country and in Southeast Asia as a whole.

The San Miguel group's enormous expansion plans for gas-fired power plants & LNG terminals are blocking the energy transition in the Philippines although comprehensive studies demonstrate the country’s huge potential for renewable energies.

HSBC is one of the largest fossil fuel investors in Europe. It holds bonds in the Philippine conglomerate San Miguel worth $81.9 million. Standard Chartered is one of the largest fossil fuel financiers in Europe. In 2024, it was one of only four European banks that supported San Miguel, providing a total of $352 million in loans and underwriting. This makes Standard Chartered the company’s largest European financier.

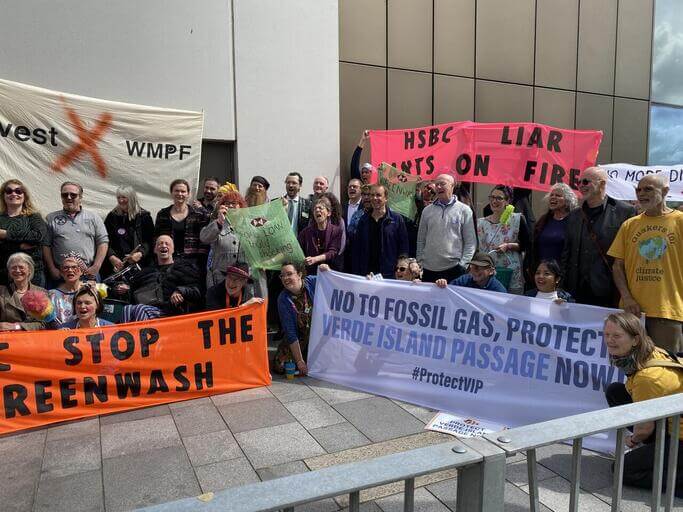

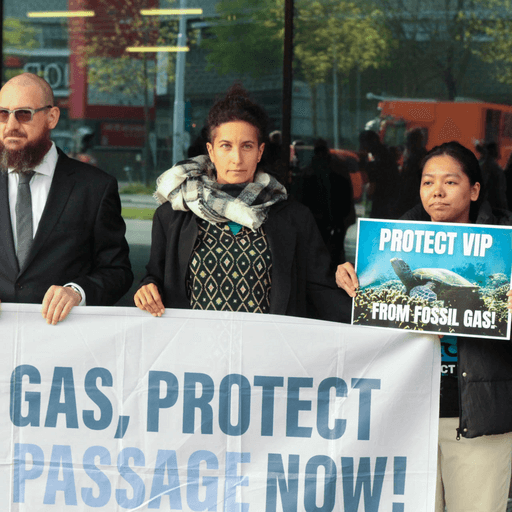

Photo: Alvin Simon for ProtectVIP